Our Views

Income splitting with prescribed rate loans

06/30/2020

The recent economic upheaval has caused uncertainty, but changes in interest rates have also created potential tax-planning opportunities.

Specifically, the prescribed interest rate has fallen to 1% as of July 1, 2020, which provides a significant opportunity to split income with a spouse, children or other family members. The new rate of 1% is the lowest the rate can possibly go, unless the yield on Government of Canada Treasury Bills were to turn negative.

How can the prescribed rate loans be used to split income?

The Income Tax Act generally prevents non-arm’s length individuals from splitting income between each other, which is accomplished by transferring income producing assets. For example, if an individual who is in a high tax bracket transfers assets to a spouse who is in a lower tax bracket, special rules would attribute the income and capital gains back to the transferor spouse. Similar attribution rules are in place to deal with transfers to a minor child.

However, a prescribed rate loan provides an exception to these attribution rules. In other words, attribution rules would not apply if a loan was used to acquire the income producing asset and the loan carries an interest rate that is equal to at least the prescribed rate at the time the loan was made. It is important that the interest is paid by January 30th of each year, otherwise the loan would be permanently offside and attribution rules would apply on go forward basis, until the loan is repaid in full. There is no time limit as to how long the loan can be in place and the interest rate can be locked in for the duration of the loan.

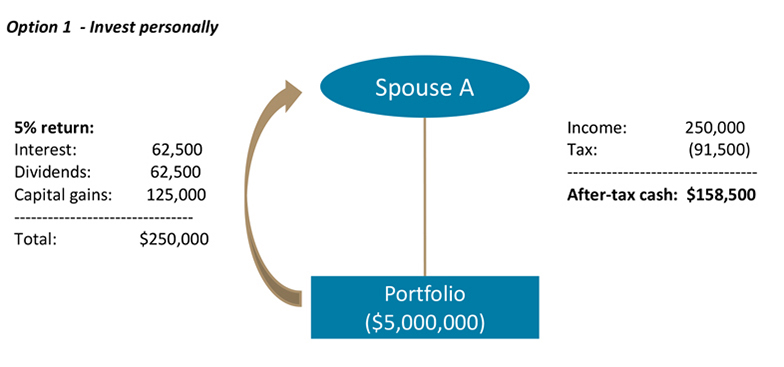

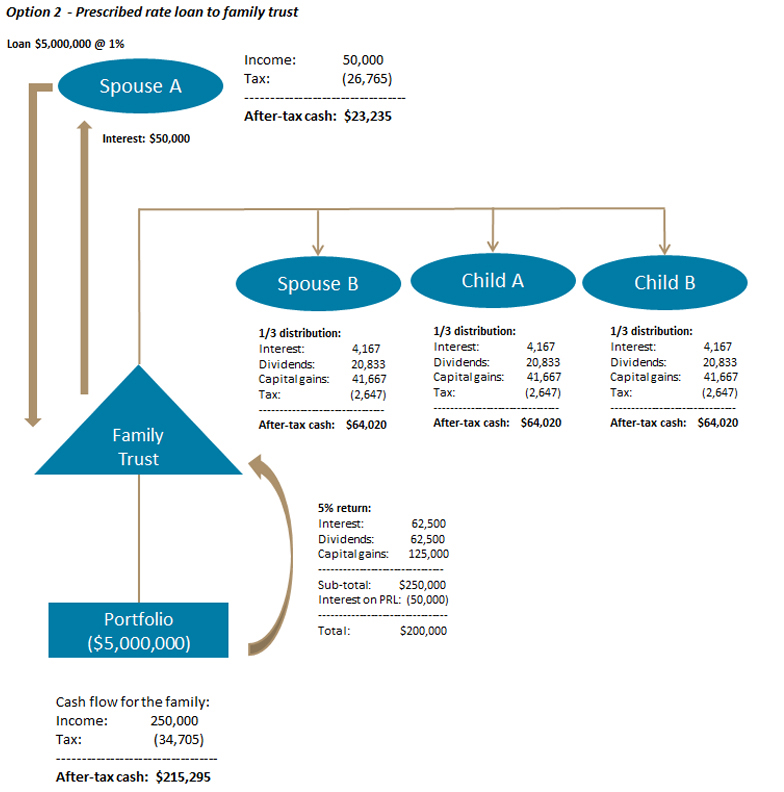

For the sake of simplicity, consider the following example: A married couple with two teenaged children. One spouse is in the top marginal tax bracket, while the second spouse has no employment income. The children attend private school and the family has been paying the tuition from after-tax income. Let’s also assume the spouse in the highest tax bracket has $5,000,000 of capital to invest, and may consider two options: 1) invest personally or 2) make a prescribed rate loan to a family trust.

By investing the $5,000,000 personally, the high-income earning spouse will pay tax on the investment income at the top marginal tax rates. Assuming a 5% return, the tax bill on $250,000 of investment income will be approximately $90,000 and household expenses and children’s private school tuition will be paid from after-tax proceeds. There is a more tax efficient way to set up this structure, taking advantage of the prescribed rate loan and the historically low interest rate of 1%:

By loaning the $5,000,000 to a family trust, the high-income earning spouse can split the investment income with family members. Under this structure, the children’s private school tuition can be paid by the family trust and the children will be taxed on their share of the investment income at lower marginal tax rates. The tax savings to the family that could be achieved under this structure amount to approximately $57,000/year.

Refinancing prescribed rate loans

Since April 1, 2018, the prescribed rate has been 2% and, as a result, many prescribed rate loan carry the 2% rate. The question arises – if you already set up a prescribed rate loan at 2%, what is the proper way to refinance it?

It would appear that simply amending the terms of an existing prescribed rate loan will not work. The rules indicate that the loan must be made at the prescribed rate that was in place at the time the loan was made. For this reason, amending the terms of an existing loan to reduce the interest rate to the new lower prescribed rate will put the structure offside.

Similarly, repaying the original loan with the proceeds from a new, lower prescribed-rate loan would not appear to be effective. CRA commented in the past that in this instance, the new loan would not be used for an income producing purpose, but rather for the purpose of extinguishing the original loan. Therefore, attribution rules would apply.

The safest method to refinance an existing prescribed rate loan with a lower prescribed rate loan is for the borrower to dispose of the income producing asset and use the proceeds to repay the original loan. Once the original loan has been repaid, a new, lower rate prescribed rate loan may then be advanced, and the proceeds could be used to acquire income producing assets. To minimize the possibility of the attribution rules applying, the new loan should be sufficiently different from the terms of the original loan. Examples of differences could include the amount and the term of the new loan.

Since the process for refinancing the prescribed rate loan includes a disposition of income producing assets, capital gains tax may arise. Therefore, it is advisable to weigh the tax benefits arising from the lower prescribed rate loan against the capital gains tax arising on disposition of the income-producing asset.

We’ve been putting prescribed rate loans in place for our clients for many years to fund expenses in a tax-effective manner – from education as shown above, to elder care for aging parents. The change to the 1% rate makes them very attractive, because the 1% interest rate will be in place for the lifetime of the loan.

Consider this an important window to split income with a spouse and glean significant tax savings in the process. Work with your personal financial team to develop a customized strategy that addresses your unique circumstances and aligns with both your short- and long-term financial goals.

The recommendations in this blog are general in nature and no specific strategy or planning idea should be undertaken without first consulting with your accountant or tax advisor. This information is for information purposes only. It does not constitute an offer or solicitation in any jurisdiction to any person or entity to sell or buy securities.

Subscribe to Our Views

*Please refer to our Privacy Policy to find out how we protect your information