Our Views

Why REITs may be the comeback story of 2021/22

02/09/2021

We’ve said it often: last year’s winners are seldom the next year’s winners. In our world of investing, with multiple asset classes to choose from, we’re constantly scanning the environment for opportunities where the return potential is enticing, and the risk profile is acceptable. For 2021, one such asset class is publicly-traded global real estate, REITs. In fact, we’ve upped our allocation to global REITs – bringing it to 4.4% in a balanced portfolio.

In this blog post, we outline why we think global REITs could deliver better returns in the coming years – and how we have positioned portfolios to benefit.

A Tale of Two Properties

For 2020, global REITs were one of the most battered sectors of the market – lagging all sectors except for energy and financials and finishing the year down 10.5% in local currency.

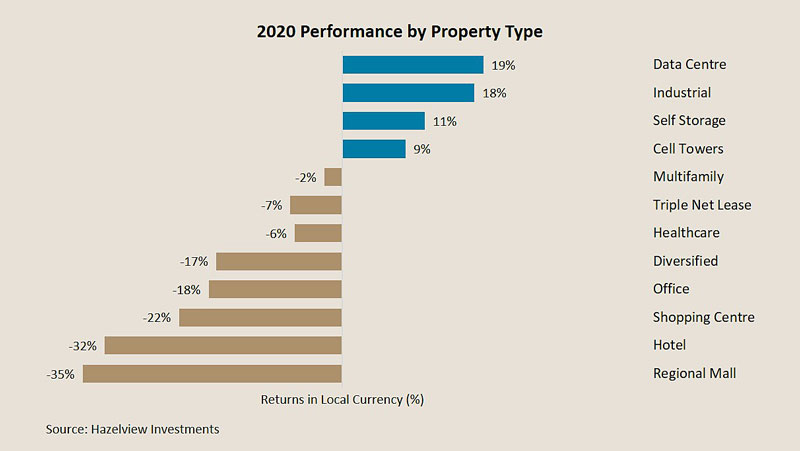

As this chart shows, real estate properties that revolve around social interaction (e.g., office, retail, hotels, multi-family residential) bore the sharpest brunt of the Covid-19 pandemic. Conversely, a few property types, such as data centres and industrials, delivered positive returns powered by the acceleration of e-commerce.

In this sharply bifurcated market, our independent global REIT manager, Hazelview Investments outperformed the benchmark by +9% (finishing almost even for the year), by actively positioning and re-positioning the portfolio for these trends.

In a recent report, Hazelview stated that they expect a great “REIT-opening” to start to unfold as the economy reopens, life returns to a “new normal” and the investment world begins to wake up to the cheap valuations for REITs relative to their fundamentals.

It’s All Relative… REITs Look Cheap by Many Measures

Relative to earnings

Although the share prices of REITs were hammered by the market, the actual earnings of the underlying businesses declined less so – just 5.8% in 2020. Hazelview expects this discrepancy to correct itself in the next couple of years – predicated on an improvement in the global economy.

Relative to public stocks

Global REITs underperformed global equities by nearly 25% USD, which is the largest discrepancy in 25 years. According to Hazelview’s modeling, this puts REITs at their cheapest and most attractive level of investment, relative to equities, in more than 15 years.

Relative to history

Looking back to the Great Financial Crisis, REITs lagged the broader market in 2007 and 2008. However, once monetary and fiscal stimulus was implemented, REITs rebounded and went on to outpace global equities from 2009 to 2013. There are obvious similarities to today’s environment. Low interest rates are an accelerant for real estate because they lower the cost of debt and support funding for acquisitions that foster growth. As long as rates remain low, and central banks have given every indication that is their intent, valuations will look attractive.

Relative to private real estate

Hazelview believes that the COVID-19-driven sell-off in global REITs has created “a unique opportunity through the public markets to own core, institutional quality real estate at prices that are unattainable in the private market.” We concur based on our experience investing in private real estate. Quite simply, private real estate valuations do not appear to have been hit as hard as their public counterparts. This valuation gap should revert to the mean once there is gathering evidence of a sustained economic recovery.

The timing and the magnitude of the great “REIT-opening” are unknown. And we are mindful that temporary headwinds remain for commercial and residential sectors. There is uncertainty as to the timing of widespread vaccine distribution. What is certain, however, is that there will be leaders and laggards within the REIT sector – just as we saw in 2020, though they will likely be different going forward. Hazelview will continue to be discerning in its selection of those REITs with strong balance sheets that will come out of the economic downturn stronger and more profitable long-term.

Subscribe to Our Views

*Please refer to our Privacy Policy to find out how we protect your information